Global New Business Highlights

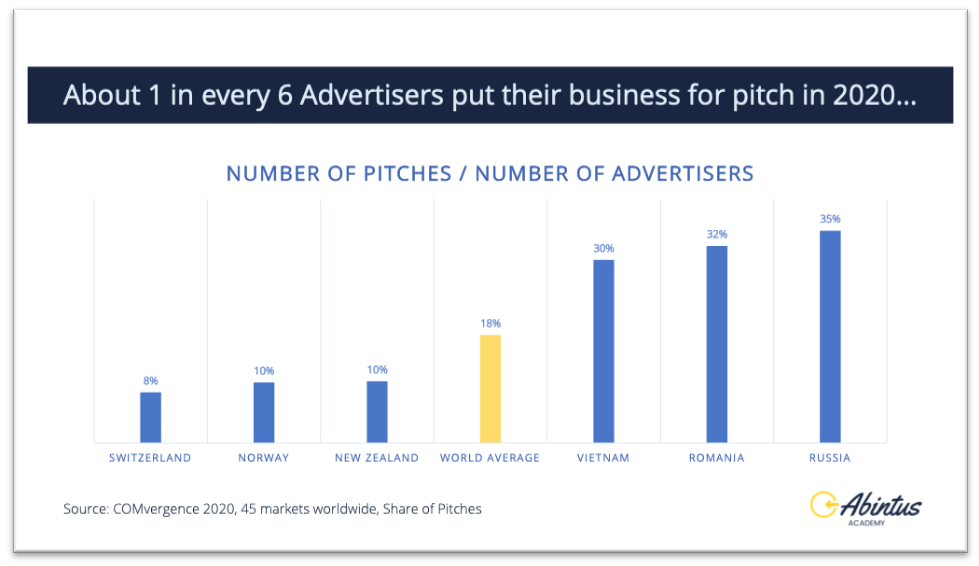

When comparing the pitch rate by market, Russia had the highest rate with 35% of advertisers pitching their media planning and buying business in 2020, compared with only 8% in Switzerland.

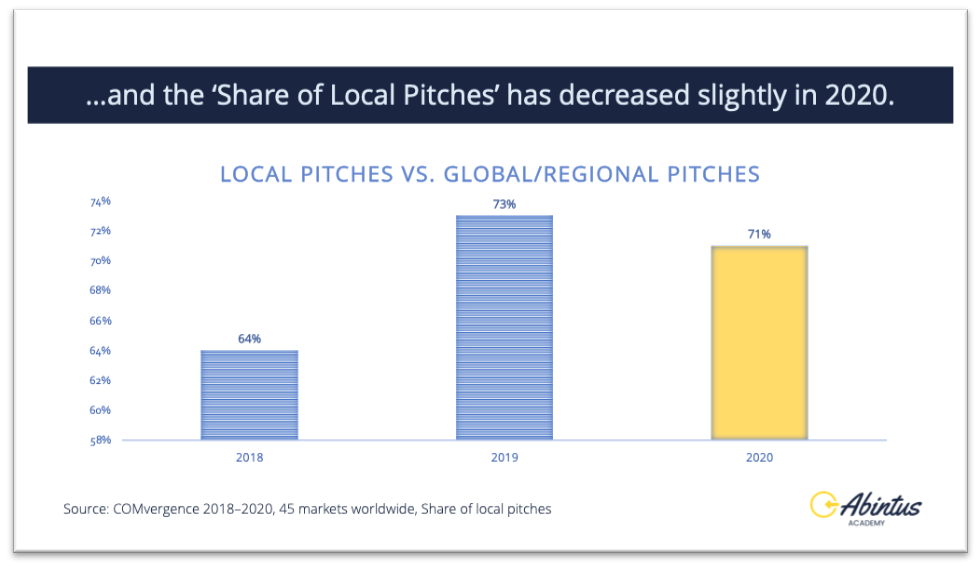

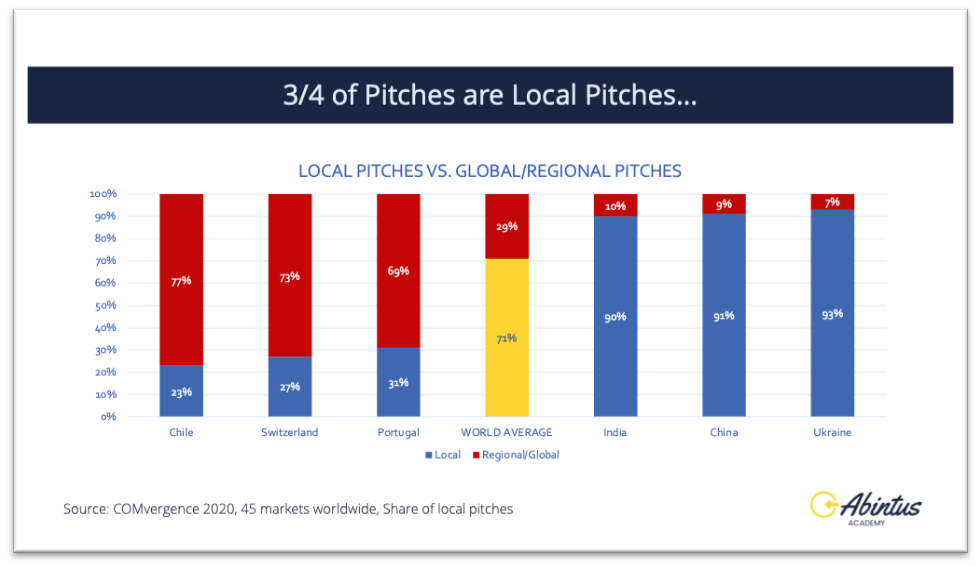

Local pitches dominated the market, even in terms of attracting major global brands. As far as pitches in the world go, 71 per cent are classified as local pitches and 29 per cent – global/regional.

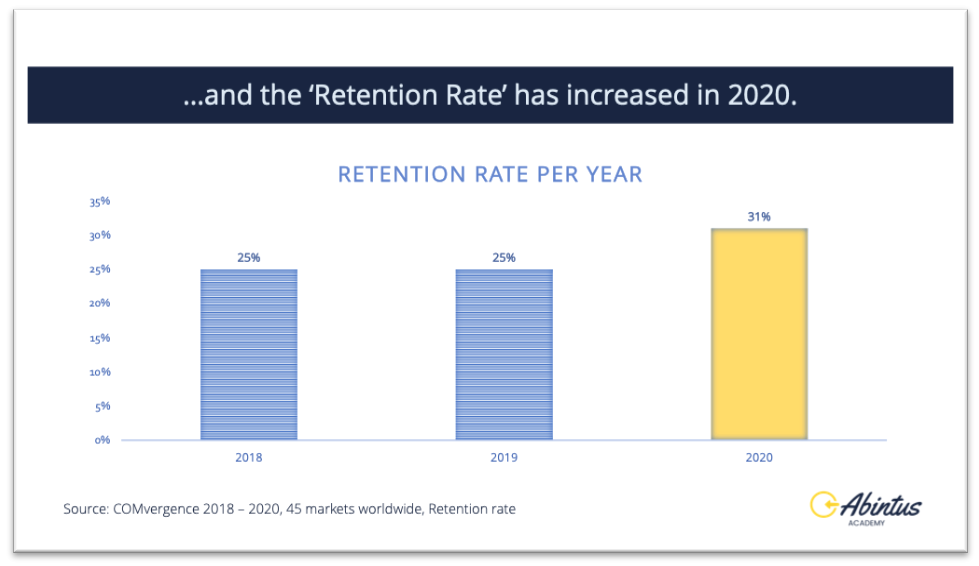

The retention rate (share of pitches won by the incumbent agencies) has increased in 2020, from 25% in 2019 to 31% in 2020.

-

Numerous international advertisers went for local pitching – Abbott, Clarins, Heineken, Johnson & Johnson, McDonalds, L’Oreal, Nestle, PepsiCo, Pernod Ricard, Red Bull, etc.

-

Pitching activity was highest in the following industries: retail (3.2 billion US dollars), food and beverages (3.14 billion dollars), FMCG – care (2.69 billion), pharmaceuticals (2.5 billion) and financial and insurance services (1.48 billion)

-

Of the total pitched billings, 10 per cent went to independent or local media agencies.

The State of Global Media Agency Pitches

As you can see, local pitches have clearly dominated the media landscape in 2020. According to media reports, challenges linked to the Covid-19 pandemic and its management have forced numerous brands to reassess their agency choices and interactions. New operating models have emerged, laying the foundations of pitching realities for the coming years (more immediate, more flexible and tailored to address the specific needs of the advertiser).

But how have global and multi-country media pitches fared in 2020? The previous section paints a less than optimistic picture for those.

A couple of major global pitches concluded successfully, in spite of industry challenges.

The biggest ones include the following:

-

Sanofi’s global pitch worth 1.06 billion US dollars in media spend and international scope

-

LIDL/Kaufland’s EU pitch worth 800 million dollars in media spend

-

Kraft Heinz’s global scope pitch worth 650 million dollars

-

Walgreens’ global scope pitch worth 450 million dollars

-

Diageo’s global pitch worth 345 million dollars

These are followed by pitches that are Europe-centric (Agrolimen, De’Longhi, E. ON, Honda, MG Motors, Whirlpool, etc.). Two pitches targeted Latin America (DirecTV, Mercado) and one for the Southeast Asian market (Coca-Cola).

Biggest Conclusions and 2021 Forecasts

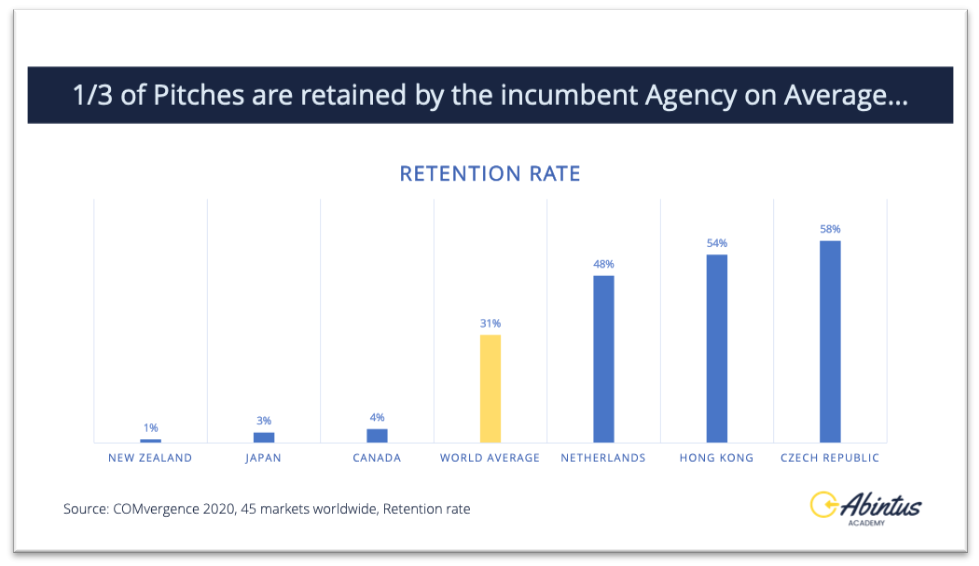

In a time of uncertainty, brands have decided to maintain loyalty and stick to what they know well. As a result, a third of all pitches were retained by the incumbent agencies, an increase against the previous years.

In 2020, we all started living in a situation that can only be described as the “new normal.” It showed both brands and agencies that you don’t need to set up a pitch in front of people. Virtual technologies and digital communication make that possible across boundaries and limitations.

As a result, we saw 47% more pitches in H2 2020 versus H1 2021. And we are now experiencing a surge of pitches in 2021.

When many advertisers are going to be on the 'pitching wagon' this year in order to improve their terms and conditions, it is important not to stand still on the platform and watch the others gain better benefits.

So if your media agency contract is 3 years old, or even older, you might want to consider pitching your media planning and buying requirements.

Getting Ready for Successful Pitching

New developments will give advertisers access to better, faster and much more customised pitches aimed at addressing their distinctive needs.

And while such prospects are being welcomed by brands across the globe, there are still some pitching complexities that have to be overcome.

Are you about to conduct a media agency pitch but you simply cannot afford a pitch consultant due to professional or financial limitations?

The Abintus Academy pitching process course can provide invaluable insight and actionable steps to deliver great results. The step-by-step instructions will save you time, provide in-depth instruction in the form of video lessons and acquaint you with the most important aspects of the pitching process.

Please follow this link to learn more about the course curriculum. You can also get in touch with us to have your questions answered.